mississippi state income tax calculator

Your average tax rate is 1233 and your marginal. Work out your adjusted gross income Net income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income StandardItemized deductions.

Tax Withholding For Pensions And Social Security Sensible Money

Mississippis SUI rates range from 0 to 54.

. The Federal or IRS Taxes Are Listed. After a few seconds you will be provided with a full breakdown. The taxable wage base in 2022 is 14000 for each employee.

Start filing your tax return now. Now that all of Johns income has been taxed according to the states respective rates well add the results together to estimate what John owes the state of Mississippi in income taxes. Mississippi Income Tax Calculator 2021 If you make 72500 a year living in the region of Mississippi USA you will be taxed 12147.

You will be taxed 3 on any earnings between 3000. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 15 Tax Calculators 15 Tax Calculators.

TAX DAY IS APRIL. Easily E-File to Claim Your Max Refund Guaranteed. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi.

There is no tax schedule for Mississippi income taxes. Select Region United States. 2021 Tax Year Return.

The Mississippi Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. The Federal or IRS Taxes Are Listed. The graduated income tax rate is.

The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. Your average tax rate is 2014 and your marginal. Detailed Mississippi state income tax rates and brackets are available on this page.

Mississippi state tax 6535. These rates are the same for individuals and businesses. Mississippi has a graduated tax rate.

The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Your average tax rate is 1198 and your marginal.

Our income tax and paycheck calculator can help you understand your take home pay. The Mississippi Tax Calculator. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income.

These tools will help you to calculate your Federal and State. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Mississippi Income Tax Calculator 2021 If you make 195500 a year living in the region of Mississippi USA you will be taxed 48731.

Mississippi Income Tax Calculator How To Use This Calculator You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April. Calculate Your 2022 Tax Return 100. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Mississippi Income Tax Calculator Calculate your federal Mississippi income taxes Updated for 2022 tax year on Aug 31 2022 What was updated. If you are a new small business owner congratulations by the.

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Mississippi State Income Tax Ms Tax Calculator Community Tax

Estimated Income Tax Payments For 2022 And 2023 Pay Online

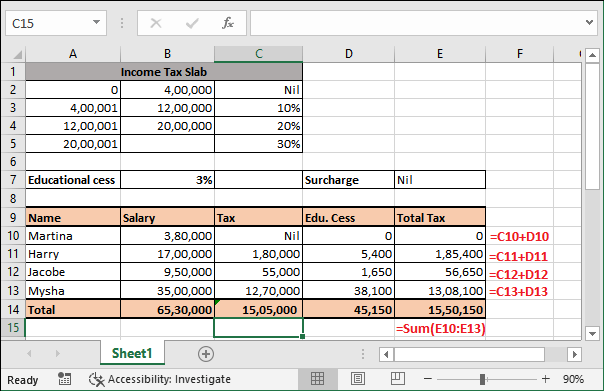

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculation Formula With If Statement In Excel

![]()

Mississippi Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Mississippi Income Tax Calculator Smartasset

Historical Mississippi Tax Policy Information Ballotpedia

Income Tax Calculation Formula With If Statement In Excel

Mississippi Retirement Tax Friendliness Smartasset

Income Tax Formula Excel University

Mississippi Income Tax Brackets 2020

State Withholding Form H R Block

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Take Home Pay Calculator

Property Tax Calculator Smartasset